Brokerage firm

Brokerage firm

Client reporting. Deliver clear, transparent reports that simplify

complex financial data, helping clients understand transactions,

holdings, and profit & loss with ease. Quick Integration.

Solution easily plugs into mobile app or client portal,

enabling rapid time-to-market and reducing implementation and

integration efforts

Private Banks and family offices

Private Banks and family offices

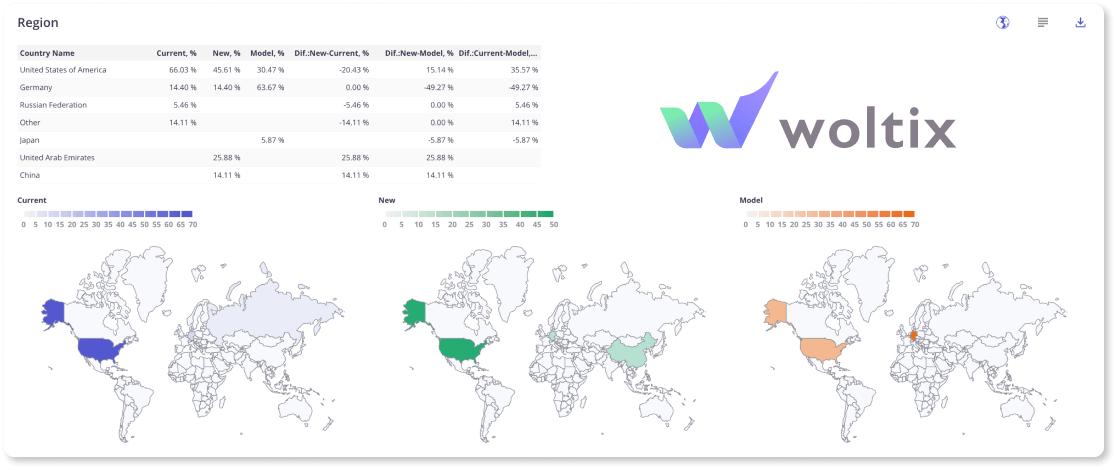

External asset management and advisory. Consolidate all client

assets into a cohesive view, reducing time on reporting

and providing a seamless portfolio overview. Comprehensive

client account management. Manage individual and grouped client

accounts in a consolidated view, ensuring organized and

efficient asset handling

In-House Analytics and Market Research

In-House Analytics and Market Research

Strategies and investment ideas management. Develop and track

investment strategies and ideas, with tools for sharing virtual

portfolio returns. Easily prepare client-facing materials

to showcase strategy performance and potential returns,

encouraging informed client engagement

Brokerage firm

Brokerage firm